The founding of Tullamore Credit Union in April 1963 was one of the best things that ever happened in Tullamore. The same can be said of the credit union movement founded in Ireland in the late 1950s. How did it come about? How was it sustained? Who were the leaders, managers and staff at the front line? The success of a community-based, people-centred and voluntary effort is all the more relevant today when people often have only machines to turn to in the provision of services and some feel disenfranchised both at local and central government level. ‘We ourselves’ was heard a lot in this ‘Decade of Centenaries’. It was also the cry of the credit union founders in the Lemass-led early 1960s when practical steps were taken to stem the flow of emigration and provide employment opportunities at home through the provision of credit where it could be useful.

In Birr, Clara and Tullamore the formation of the credit union has been described as the best thing that ever happened in the respective towns. Tullamore Credit Union was founded in April 1963, and was the first in County Offaly. Tullamore CU is a remarkably successful organisation which now employs over forty people and has assets of €300 millions of which over €80 million is lent out. Tullamore Credit Union is not unique in its successful approach to lending and saving over the last 60 years and the credit union movement across Ireland has yielded a strong social dividend for its members and the wider community.

The credit union was first started in Ireland in 1958 and coincided with a time when there was new thinking about how to get Ireland out of the rut of massive emigration. T.K. Whitaker had just published, as Secretary of the Department of Finance, his Economic Development. In 1959 de Valera relinquished the long grip he had on the leadership of the country and moved from the taoiseach’s Office to the presidency. Sean Lemass, now with a secure hold on power, was determined to make his mark in the few years left to him.

There was new social thinking in the country and it was not surprising that some of the younger Catholic priests wanted to participate and bring about social change in their own parishes. In Tullamore it was not one of the parish clergy but instead a priest who had been on the Catholic Mission to South America who brought the idea to what was then seen as a progressive and prosperous midland town. Whether Fr Fintan Cassidy, who was then in his early thirties, was influenced by what was happening in Ireland with new credit unions being established, or was wholly inspired by what he had seen in Peru, we may never know. We have his testimony to say that it was the Peru experience.

Why was the credit union so successful in Tullamore? First of all Fr Cassidy selected his people well for the start up. Almost all were drawn from the educated middle class and from a generation which was strong on supporting social causes. In those early years of the 1960s the Legion of Mary, The Knights of Columbanus, the confraternities, the St Vincent de Paul Society, the Patricians all thrived. Ten years later it would be the United States-inspired groups such as Junior Chamber, the Lions Club and the Association of Business and Professional Women that would grow in prominence.

The make-up of the first board did not include many from the private sector. However, within four years some of the professionals and civil servants had departed making way for younger people with management skills and drawn from the prominent local firms of Salts, Williams and P. & H. Egan’s. These were all major firms with systems and training in place and targets to be met. Some of the key directors in the credit union over the thirty years from the 1970s were very much a part of the change then going on in Irish business and the opening of new markets in Ireland and abroad. Those in the Williams firm were subject to a whole series of changes in retailing, in wine and spirits and in the farming sector. In Salts (Tullamore Yarns) it was a case of coming out of the sheltered protective tariff environment from the late 1930s and moving to free trade with all that it would bring for competition and its eventual closing in 1982. Whitaker had urged the free trade route on Lemass and he accepted, but it was known that the old sheltered industries would suffer. In Offaly both Salts and Goodbodys, two of the largest firms in the county, closed in the 1980s after struggling through the 1970s.

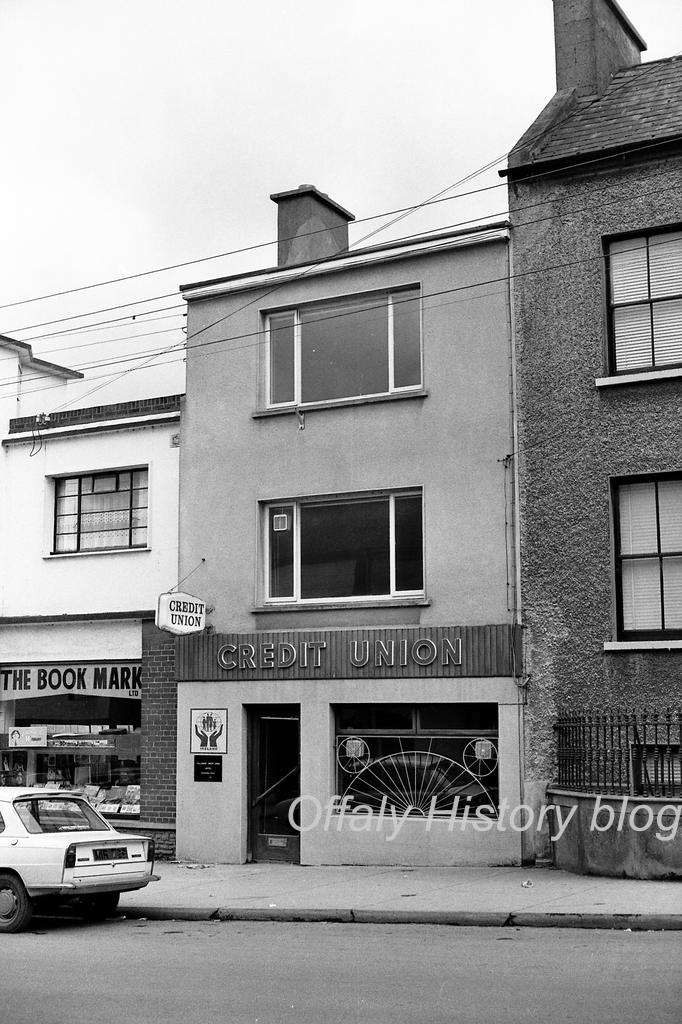

The other curious thing is that the directors of the credit union from the mid-1960s were people who were in for the long haul in Tullamore. Some were called ‘blow-ins’, but they were not ‘runners’ in that they remained on in Tullamore as permanent residents, or were natives of the town and choose to remain there. This gave continuity and probably helped to avoid rancour. The directors showed a remarkable amount of cohesion born of the success of the undertaking from its foundation. This made for continuity in objectives over the long period from 1971 when the first purpose-built credit union office was completed in High Street, to the remarkable ongoing development at Patrick Street right up to 2012 when the last office extension was completed. In technology the progress was even more so, from the first computer in 1981 to the adoption of the Wellington company in 1990 as the credit union’s technical development partner. Tullamore was fortunate in having a pool of talent and business experience in its directorate and that, combined with close links with the management, was able to drive change.

Tullamore Credit Union was the first in the country with some major initiatives. First was the adoption of the ATM service in 1996. Second, the provision of a social fund from the year 2000, based on a section of the 1997 Credit Union Act that allowed for this. Third, was leaving the Irish League of Credit Unions in 2002 over a dispute regarding the League’s failed computer project and who was going to pay for it. The larger credit unions had different needs and required a forum with similar-sized organisations to share concerns. The Credit Union Development Association (CUDA) was established in 2002 and now has major layers. Tullamore as one of the largest community-based credit unions is now probably in the top ten.

The credit union movement in Ireland was, for the most part, in a very strong position and has shown its worth in the period since the financial crisis of 2008. The few exceptions do not take from the considerable achievement here.

The credit unions were established to make credit available to people who, in the l950s and 1960s, were paying penal interest rates by way of hire-purchase agreements, high margins to travelling salesman, and worst of all moneylenders. Its success was largely because its birth coincided with the growth of the market economy in Ireland in the 1960s and the growth in demand.

The single greatest strength of the credit union movement is the voluntary commitment, knowledge and dedication of its directors and the loyalty of its members. The greatest threat appears to be now coming from those who would over-regulate the micro environment and under appreciate the importance of voluntary effort, know how and autonomy, both in local government and local service enterprises. That said the responsibility is now very great and well-ordered services important.

The other challenge is for credit unions to consolidate resources while finding a way of maintaining local knowledge and loyalty. The likely scenario is amalgamations in County Offaly and Tullamore has amalgamated with Kilcormac – it having grown from Tullamore in the early days. Clara with Moate, Ferbane and Banagher. Birr joined up with credit unions in Athenry and Portumna. Edenderry is now part of Croí Laighean comprising of some credit unions in Kildare including Leixlip and Kildare. Amalgamations reflecting diocesan rather than county boundaries perhaps.

Credit unions are determined to ensure that the local model of saving and lending can survive and continue to provide credit, based on the knowledge, trust and appreciation of the member, while giving back to local communities a fair proportion of the profits generated. To achieve that it will continue to need the wholehearted support of the community and the participation of people who are willing to serve as directors and willing to work to provide a credit line in the community and an incentive to save. The stifling of the economy in the 2009-15 period through lack of credit made it obvious that for growth credit is essential. Throughout Ireland, and in Tullamore, the credit union model of over 60 years has been remarkably successful. The provision of housing loans on a larger scale will be much appreciated by the local public.

Great challenges came to the banking sector in 2008-11. At that time Tullamore town was about to have ten banks. Since then that has reduced to two main banks and two former building societies. Ulster Bank has just closed after 130 years in Tullamore town. Tullamore Credit Union probably employs more now than all the other banks in the town combined and has an asset base to match. We congratulate TCU on its sixtieth anniversary and look forward to its 75th.

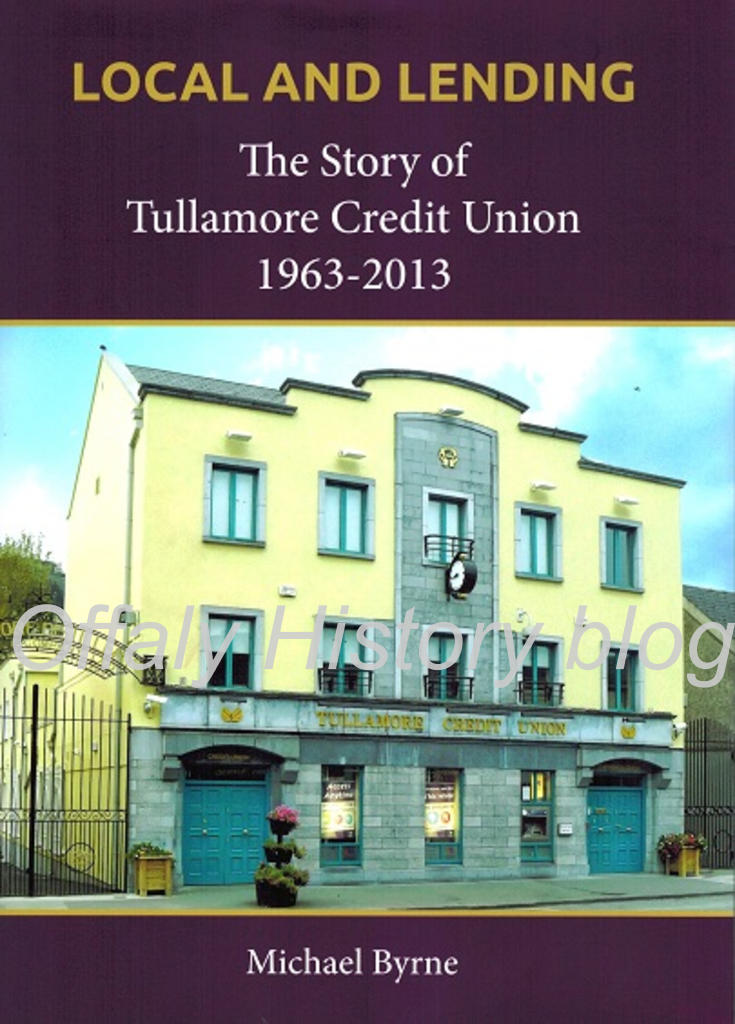

Local and Lending: The story of Tullamore Credit Union, 1963-2013 by Michael Byrne

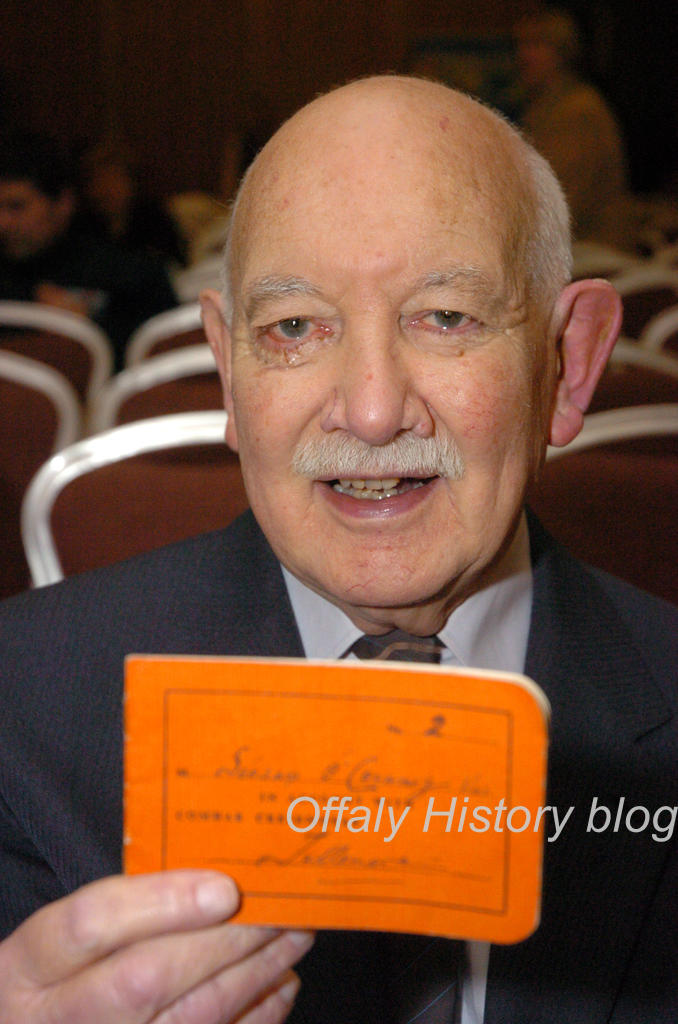

With contributions from Dennis Daly, Joe Kenny, P.J. Egan, Eilish Horan and Brian Gunning

Published by Esker Press for Offaly Historical & Archaeological Society, Tullamore, 2015, 300 pp, hardcover, price €16.99 ISBN 9781909822030. This one has over 400 pictures, full colour and no need to borrow to buy it! It can be bought online also from http://www.offalyhistory.com.